Dementia is the UK’s number one killer and the greatest but most under-estimated health and care issue of our time. Responding to its challenges will reshape the health sector and the role of private capital as a catalyst for change will be crucial. Following our landmark study with the Alzheimer’s Society, we consider the ways in which investors should engage with this complex and destructive disease.

In May 2024 CF published a report commissioned by the Alzheimer’s Society investigating the social and economic impact of dementia in the UK. By leveraging one of the largest linked, record-level healthcare datasets of its kind CF was able to develop a detailed understanding of the healthcare resource use of people with dementia. Read a summary of the report here.

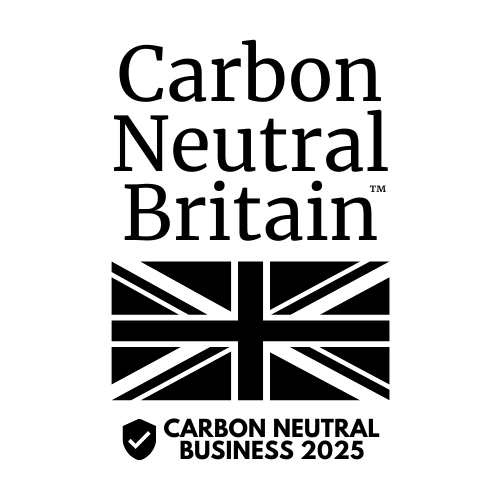

The headline figures are sobering and present significant structural and financial challenges to the UK. Based on research studies and ONS projections and by accessing real world data from Discover-NOW and the population in North West London, CF calculated that the number of people living with dementia is expected to grow from 1m in 2024 to 1.4m in 2040, with prevalence increasing from 1.4% to 1.9% due to an ageing population.

Dementia prevalence now and in the future

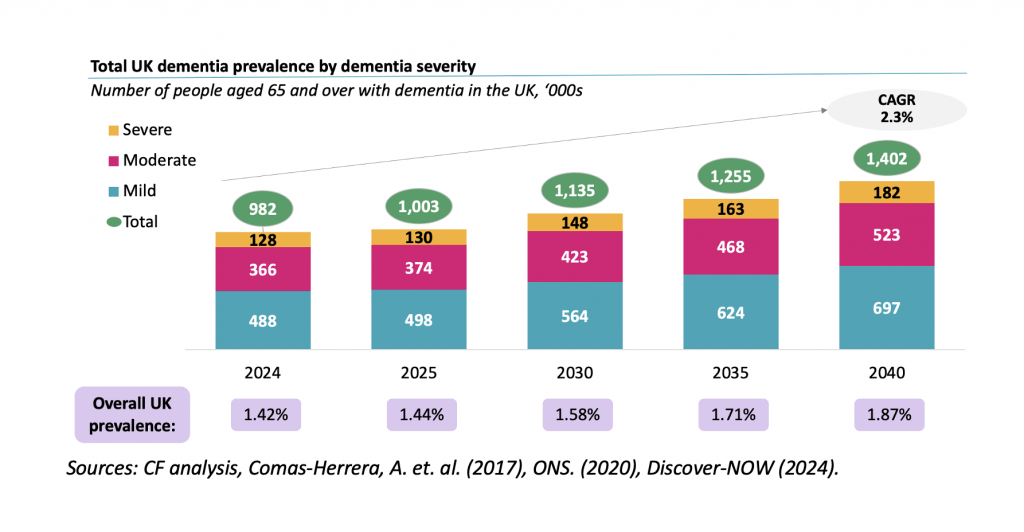

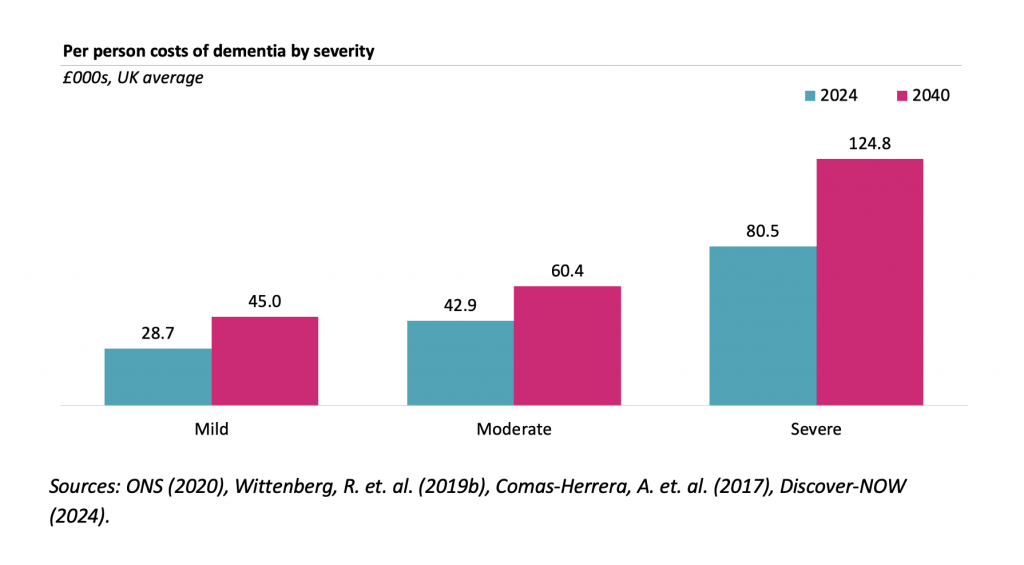

Based on analysis of over 26,000 patient records in the Discover-NOW dataset, CF analysis shows the total cost of dementia in the UK growing from £42bn in 2024 to £90bn in 2040. The key costs break down as:

- Unpaid care will grow from £21.1bn (2024) to £40.1bn (2040)

- Social care will grow from £17.2bn (2024) to £40.7bn (2040)

- Healthcare will grow from £7.1bn (2024) to £13.5bn (2040)

Cost of dementia now and in the future

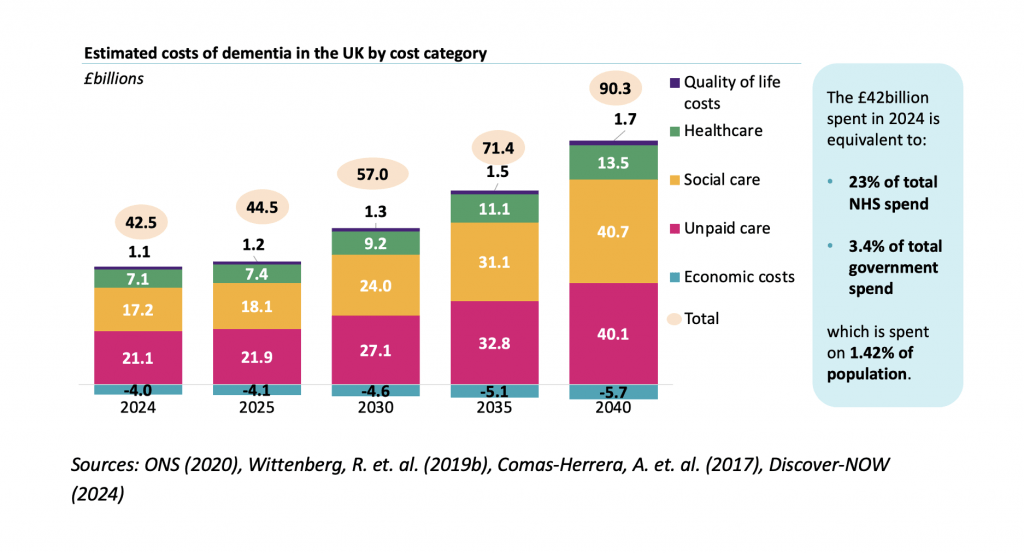

62% of these costs are today paid for by families – representing all of the unpaid care costs and the majority of social care costs.

Who is covering the costs?

The increasing prevalence of dementia is clearly unsustainable for the UK – both clinically and financially – against the context of today’s health and care system. Limited availability and poor coordination between health and social care services currently results in delays in referrals and care planning. An already strained workforce will also struggle to attract and retain staff based on today’s low wages and challenging working conditions. Variation in care quality, historical underfunding, an over-reliance on unpaid care, regional challenges and rising costs combined are driving the need to reimagine the dementia landscape. The first wave of effective Disease Modifying Therapies (DMT) for Alzheimer’s Disease is on the horizon in the UK and this is paving the way for further innovations, but we remain some distance from a cure for dementia.

Since publishing the report CF’s experts have held a series of briefings with investors, considering its short, medium and long-term implications and, outside of the development of new therapeutics, CF believes there are five key ways in which investors can respond to the challenge of the UK’s increasing dementia burden:

Expedite Diagnostic Pathways

Increasing prevalence of dementia will exacerbate existing capacity challenges for the health system. Realising the benefits of disease-modifying treatments (DMTs) and non-pharmacological interventions (NPIs) such as diet, exercise, and cognitive stimulation, is dependent on early diagnosis. Delaying or even reversing disease progression and positively impacting cognitive function can only be achieved by expanding diagnostic capacity and increasing access to imaging techniques like MRI and PET scans, as well as cerebrospinal fluid analysis.

Increased capacity is driven by a need to increase the reach and effectiveness of dementia diagnostics. With only 65% of cases in the UK currently being diagnosed, prevalence is expected to rise 40% in next 16 years, and as and when DMTs are introduced they will require definitive diagnosis (initially by PET or CS). Patients will also require monitoring for brain swelling by MRI. Increasing diagnostic capacity is capital intensive and typically requires multi-year investment to deliver returns, which has recently attracted infrastructure funds such as DIF and iCON Infrastructure to the UK radiology market. We expect this trend to continue.

Creating capacity is only half of the battle, however. Improving awareness and changing attitudes among patients and clinicians around the early signs of dementia is also crucial to bending the cost curve. There are high levels of undiagnosed dementia cases with other co-morbidities and other ageing-related conditions masking the true disease burden. There are therefore opportunities for technologies and service providers focused on early detection of dementia symptoms, in much the same way cardiology and oncology have benefitted from early intervention. DMTs are a big opportunity but will likely be expensive and put further pressure on existing diagnostic capacity.

Address Bed Capacity

The UK faces a critical challenge of total bed capacity, the distribution of existing supply and the appropriateness of facilities for delivering severe dementia care. By 2040, the UK will require an additional 100,000 care beds to adequately meet the needs of individuals with dementia. The escalating demand for specialised care, tailored to the varying stages of the disease (mild, moderate, severe), further exacerbates the issue. Over the past 5 years the supply of care beds to the market has shown a net decrease and with construction costs not compatible with current achievable fee rates (outside of the self-pay market) it is difficult to see where excess bed capacity will come from.

It seems likely that the self-pay and local-authority funded models of provision will continue to diverge as those with the ability to pay will continue to seek higher quality accommodation and environment whilst local-authority funded care homes will continue to face significant financial constraints. Beyond the quality of accommodation, a bigger concern is the significant variation in the quality of care and the extent to which residents receive the indicated wide range of interventions including social interaction, exercise, nutrition and mental stimulation.

This dynamic creates opportunities for those investors holding the prime assets in the market to achieve a price premium but new financing and commissioning models will be required to meet the wider local-authority funded market. As CF’s report also shows, the distribution of dementia prevalence is uneven across the country and future demand is likely to fall heaviest in areas of the country worst prepared to deal with increased burden. Targeted investments in areas with higher concentrations of dementia cases will be essential to ensure equitable access to care across the UK.

In addition to these needs in care home beds, the rising burden of dementia will place additional pressure on NHS capacity. NHS England estimates that 25% of NHS general and acute beds are for dementia patients who stay twice as long as other patients. Given the 40% increase in prevalence, this is expected to grow by 10,000 beds – equivalent to 20 District General Hospitals. It seems likely this will place increased pressure on NHS elective care and lead to an even greater emphasis on ensuring high quality dementia care is in place outside of NHS hospitals.

Enable New Care & Funding Models

Responding to the dementia challenge will require a recalibration of existing care models – both from a funding and service delivery perspective. Social care reform in the UK is arguably decades overdue with political trepidation from all parties allowing existing flaws to stubbornly persist and worsen over time. While the scale of the dementia challenge facing the UK should create a burning platform for change, the fiscal environment leaves little room to manoeuvre in increasing state funding. Hence, reform of social care will need to focus instead models of commissioning and payment that deliver better outcomes in a more cost-effective manner.

Evidence suggests earlier intervention is most effective, meaning identifying individuals with Mild Cognitive Impairment (MCI) even before diagnosis as the mild stage of dementia, emphasising independent living through personalised support and home modifications will have a role to play. This suggests that there will be increased awareness and demand for high quality personalised support. This could play out in several ways. First, care homes may increasingly differentiate on the amount, range and quality of personalised support they provide; this should naturally happen first in the self-pay market. Second, it seems likely that demand for extra care delivered into local authority funded care homes will increase. Third, given the new evidence on the impact of these interventions leading to better outcomes, it seems likely that differentiation on outcomes could emerge and/or that it is possible that NICE, local authority commissioners of care, or the Care Quality Commission (CQC) could specify higher standards of care; this will require the data in place to do this.

It is clear domiciliary care provision is not fit for purpose. Two to four visits of 15-30 minutes are simply not long enough to provide the range of support indicated by the evidence. Again, this suggests there will be a growing market for self-pay home care providers to deliver an offer that aligns with the evidence.

Also, novel models like dementia villages, proven successful in other countries, offering a community-based alternative to traditional care homes could attract investor and operator attention. However, the UK currently lacks the skilled staff to operate and manage such specialised environments so the viability of any new models will be dependent on addressing the workforce crisis facing social care. There is also concern about whether the UK has the requisite space where the population lives for these models, or whether culturally there is interest in them.

Aligning funding incentives across the commissioner landscape will also be a crucial part of changing care pathways. Current state-funded care suffers from both affordability issues but also siloed budgets between health and social care. Caring for individuals with dementia in fit for purpose facilities may be the goal but too often people present in hospitals occupying vastly more expensive acute beds.

It is also likely that investment models will come under pressure. The margins on local authority funded provision have attracted attention as commissioners ask why they should be paying private equity returns for stable investment in real estate; this could accelerate the drive to a split between property company and operating company to seek to achieve lower returns expectations on assets and hence lower costs.

Investors and operators that can reduce healthcare resource utilisation among dementia patients should deliver significant whole-system benefit.

Support Digital Innovation

The dementia challenge also brings opportunities for digital innovation and the adoption of new technologies to improve care and support. As with the wider health system, there is vast potential for harnessing digital technologies such as artificial intelligence across the pathway. AI-powered diagnostic tools can aid in early detection and monitoring of disease progression, leading to timely interventions. AI-driven non-pharmaceutical interventions, like personalised music therapy, can also improve mood and reduce agitation. Furthermore, AI-enabled monitoring systems can detect falls and assess mood, enhancing safety and well-being.

The data generated from these digital technologies can provide valuable insights into the burden of disease, progression patterns, and the impact of various interventions. These datasets can inform the development of more effective treatment plans and care strategies, ultimately improving the quality of life for individuals with dementia.

Clearly the challenge for both investors and health leaders is creating both the technical infrastructure and behavioural habits – among clinicians and patients – to realise the benefits of dementia-focused solutions. Embracing such advancements can empower healthcare providers to deliver more personalised and effective care, enhance the lives of individuals with dementia, and alleviate the burden on caregivers. However, scaling businesses delivering such technologies has proven complex and fraught with investor danger in other health sub-sectors, with the potential for super returns matched by high levels of valuation volatility.

Expand Data Environment

Much of the promised benefit of digital innovation is dependent on the UK making significant progress in coming years around data infrastructure. The drive to share data derived from electronic patient records through the expansion of Secure Data Environments and the Federated Data Platform will provide the foundation for analysing complex data related to disease progression and outcomes.

Diverse factors, including care homes, informal carers, and healthcare apps, will contribute to these environments, enriching the dataset with real-world experiences and insights – but without the architecture in place investors and operators will struggle to deliver on the potential of advanced technologies. Today’s siloed approach, where data is inconsistently collected and stored in multiple places, is a major hindrance.

Shifting the approach of regulators such as the CQC from physical inspections to data-driven quality indicators will also be a crucial step in creating a market for digital innovation in dementia. Integrating data from diverse sources can streamline reporting processes, reducing the administrative burden on health and care providers – and regulators – enabling them to focus on delivering personalised, patient-centred care. The expansion and maturation of Secure Data Environments will therefore be vital for both unlocking investor value and responding to the dementia care challenge.

Please contact us today to find out more about this research and our work in life sciences and health investing.