The UK has lost a decade of innovation and progress within the life sciences industry through lack of funding. It is estimated that the lack of investment in research & development and manufacturing has potentially cost the UK economy £45.1 billion.

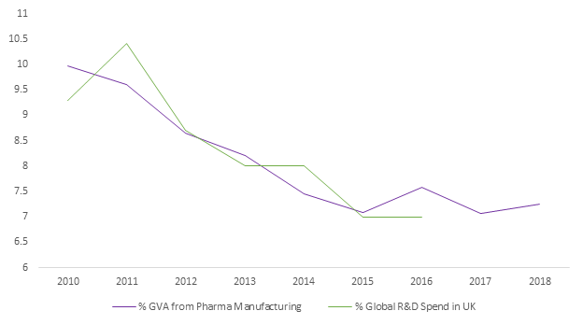

UK think-tank IPPR’s new report “A Lost Decade” which will be published later this year, delves into the state of the current life sciences industry within the UK, placing it within a global context over the past decade. IPPR have chosen to reference analysis conducted by CF in 2019, to determine a tangible impact that renewed investment could have on the UK economy. The stark results of our analysis (Figure 1) show the impact a lack of funding has had on the wider UK economy, and our international dominance has declined within the space of a decade.

Figure 1

The UK has lost a decade in progressing the life sciences

The change in life science global research spend (%) in the UK and life science GVA as a percentage of total UK manufacturing industry

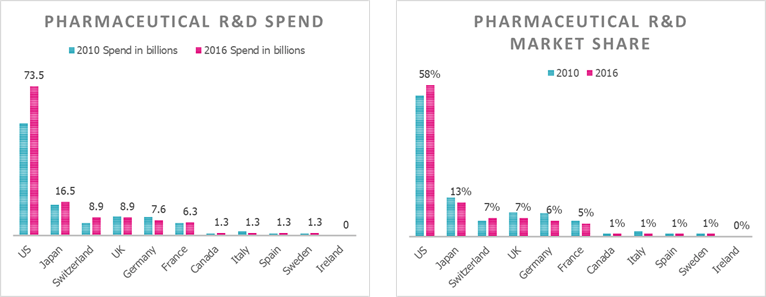

CF has been analysing data from the Pharmaceutical industry, focusing specifically on R&D and Marketing. In 2006 the UK held 8.3% share of pharmaceutical R&D spend, within ten years this had dropped to 7%, whilst the US’s share has grown from 53% to 58% and neighbouring Switzerland has seen their share increase from 4% to 7% (Figure 2).

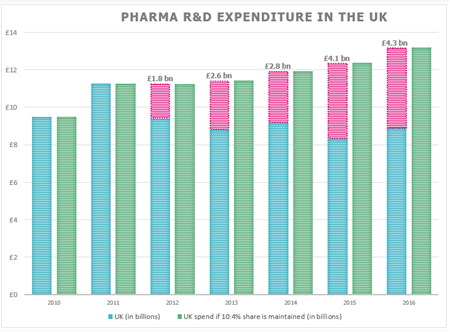

A decline in R&D results in loss of £15 billion over 5 years

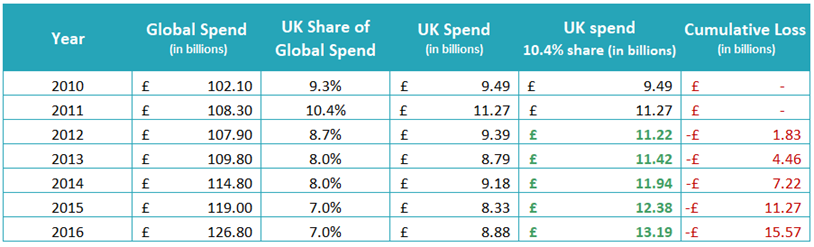

Our analysis covered data spanning from 2011 up until 2016 using recently published figures from ABPI-UK and Evaluate which details worldwide pharmaceutical company R&D spend. The approach taken was to focus solely on modelling a scenario for the UK pharmaceutical spend based on maintaining a 10.4% market share achieved in 2011.

Sources: ABPI-UK share of global pharma R&D expenditure: https://www.abpi.org.uk/facts-and-figures/science-and-innovation/worldwide-pharmaceutical-company-rd-expenditure-by-country/

EvaluatePharma 2019 – Worldwide total pharma R&D expenditure: https://info.evaluate.com/rs/607-YGS-364/images/EvaluatePharma_World_Preview_2019.pdf

Total global pharmaceutical R&D spend was converted from USD to GBP using a fixed exchange rate for the period 2011-2016 to avoid noise from fluctuations in currency value. Utilising the GBP spend we extrapolated the estimated spend the UK would have spent if it’s market share had maintained – we are acknowledging that we are excluding other macro factors which may have affected other global markets during this period.

In 2011 the UK held a 10.4% share of market, spending £11.27 billion within R&D alone, when compared to 2016, the share of market has dropped to 7%, resulting in depressed spend of £8.88 there is a gap of £4.31 billion in spending.

Sources: ABPI-UK share of global pharma R&D expenditure: https://www.abpi.org.uk/facts-and-figures/science-and-innovation/worldwide-pharmaceutical-company-rd-expenditure-by-country/

EvaluatePharma 2019 – Worldwide total pharma R&D expenditure: https://info.evaluate.com/rs/607-YGS-364/images/EvaluatePharma_World_Preview_2019.pdf

Our calculations predicted the annual loss of spend based on the actual spend versus the predicted spend if the market share had not decreased. The cumulative spend lost during the period between 2011 and 2016 amounts to £15.57 billion.

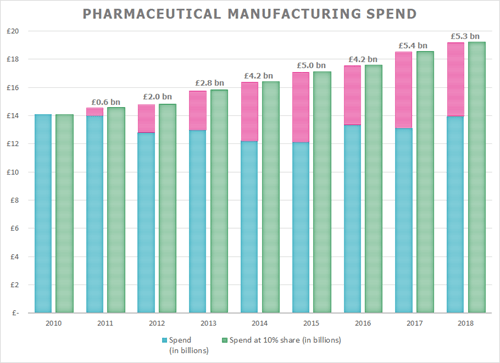

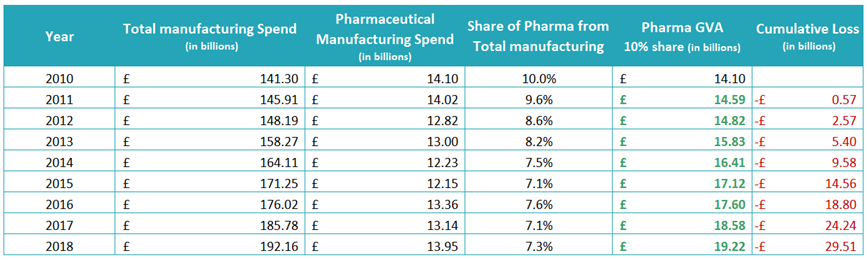

Decline in Pharma manufacturing GVA share results in £29.5 billion loss over 8 years

To determine the loss of spend within the pharmaceutical industry, data were evaluated from 2010 up until 2018 using recently published figures from ONS which details total spend across 57 industries spanning manufacturing within the UK. The approach taken was to focus solely on modelling a scenario for the UK pharmaceutical manufacturing spend based on maintaining 10% share achieved previously achieved in 2010 and 2011.

Figure 4

Sources: ONS – pharma manufacturing GVA: https://www.ons.gov.uk/economy/grossdomesticproductgdp/datasets/ukgdpolowlevelaggregates

Utilising the GBP spend from the ONS data we were able to estimate the spend pharmaceutical spend would have been if the share had not declined and had stabilised at 10%. Again, this data modelling acknowledges the estimated share remaining the same does have to excluding other macro factors which may have affected other manufacturing industries during this period.

Our calculations predicted the annual loss of spend based on the actual spend versus the predicted spend if the market share had not decreased. The cumulative spend lost during the period between 2011 and 2018 accounts to £29.51 billion.

Sources: ONS – pharma manufacturing GVA: https://www.ons.gov.uk/economy/grossdomesticproductgdp/datasets/ukgdpolowlevelaggregates

In 2011 pharmaceutical manufacturing accounted for 10% of overall manufacturing spend, the equivalent of £14.10 billion. Trending in the same manner as R&D spend, by 2018 the share of the market declined to 7%, resulting in depressed spend of £13.95 which resulted in a gap of £5.27 billion in spending.

When coupling the gap of £5.27 billion from manufacturing and £4.3 billion from R&D, we can safely determine that the total loss across the pharma industry would amount to a £9.6 billion loss to the UK economy overall.

Acting on the data

“A Lost Decade” delves into how these statistics can demonstrate the ramifications a drop in spending has on health within the UK and sets out a plea for spending levels to be reviewed, in light of the dwindling market share the UK has both within R&D and manufacturing across the pharmaceutical industry.