Health Investing

Unlocking value in health through expert diligence

Every healthcare transaction is unique, presenting its own set of challenges and opportunities. Whether you’re engaged in an acquisition, divestiture, forging a strategic alliance, or shaping your corporate strategy, it’s vital that due diligence is sufficiently informed with enough expert input to optimise returns and drive deal value.

As award-winning experts in healthcare, we use our unparalleled industry knowledge around health systems, life sciences, data innovation and health investing to support you on your investment journey, whether that’s diversifying into new markets or expanding a current service offer. Our highly experienced due diligence advisory team is committed to guiding you through every stage of a transaction – whether that’s buy side or sell side – ensuring that you are well-informed and well-prepared as we navigate the intricacies of your deal. Partner with us and gain the 360° insights needed to make informed decisions that build lasting enterprise value.

Our approach

CF’s approach is to act as a catalyst for change, providing real solutions to complex, entrenched problems. Our health investing, data and health systems consulting team offer a dynamic blend of knowledge, encompassing commercial, operational and financial expertise, generating real value at every stage of the deal lifecycle.

Experts in healthcare:

- Delivered 1,500+ engagements for clients over a decade – which has resulted in our deliverables being widely used in 70% of integrated care systems and 50% of the top pharma companies

- Financial expertise with 100% of CF’s finance practice holding accounting qualifications.

Award winning data services:

- Access to more healthcare data than any other company in the UK

- Our experience of health systems and financial sustainability, combined with data insights capabilities, uniquely qualifies us as an advisor to the private sector.

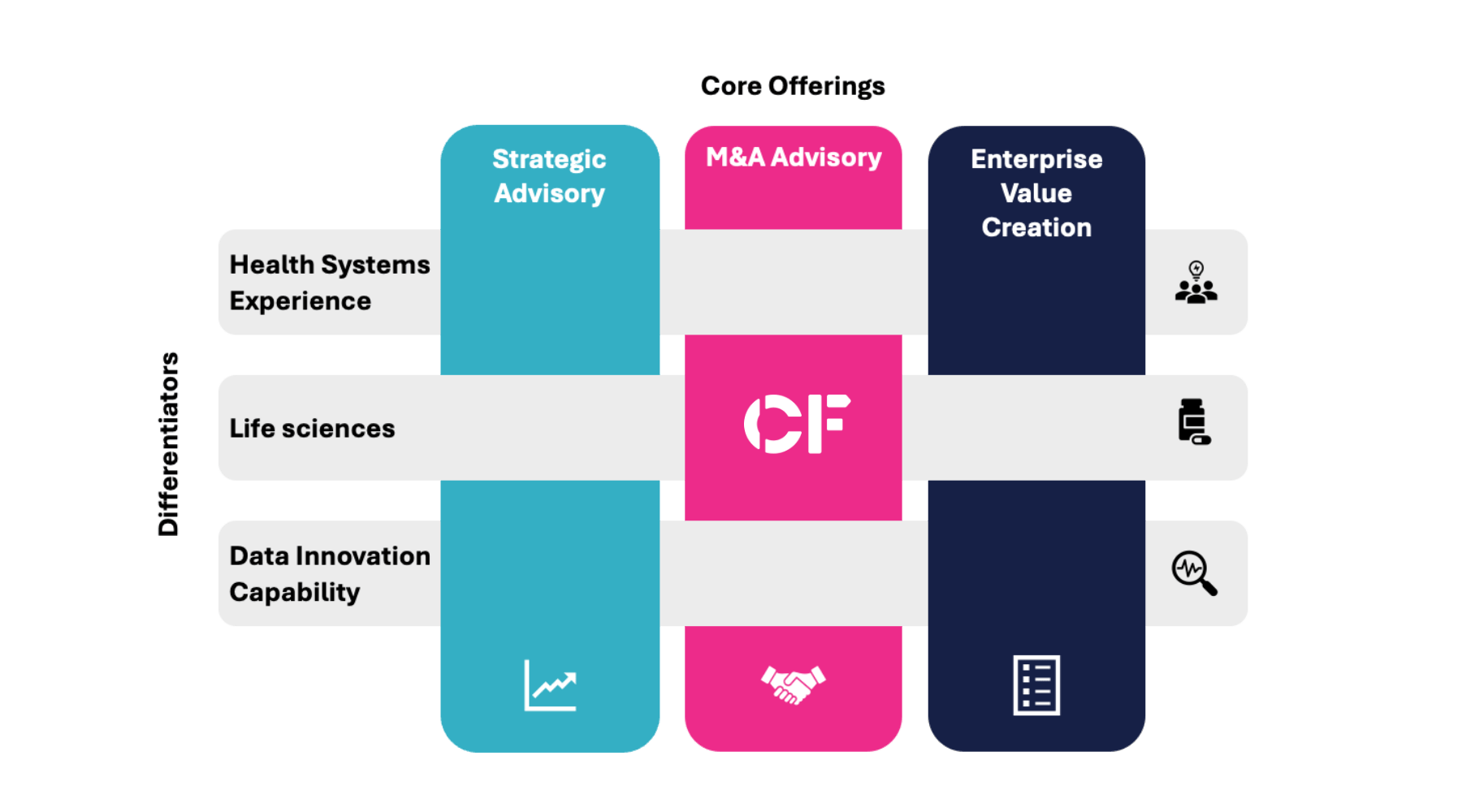

Our offers

We provide the strategic insight you need to grow, whether that’s by expanding existing services and companies, branching into new markets, or via acquisitions. This includes rigorously assessing available options and making recommendations that generate value, enabling you to create a competitive and sustainable growth strategy.

We can also help stakeholders understand the implications of growth on your wider organisation and partner with business units to redesign organisational infrastructure to deliver your value proposition.

We regularly work with boards in both the public and private healthcare markets to refresh corporate and business unit strategies, and to develop roadmaps that accomplish objectives. Our recommendations help clients to:

- Assess challenges and threats in the public and private healthcare markets

- Appraise technology and new models of care to ensure strategies are future-proofed

- Pivot or change strategic approach to achieve goals more rapidly.